Suspension of the expiry of the tax assessment period against the supplier in property development cases - BFH ruling V R 37/10

expiry tax assessment period prperty development

Facts: Initially reverse charge applied to construction services, later corrected

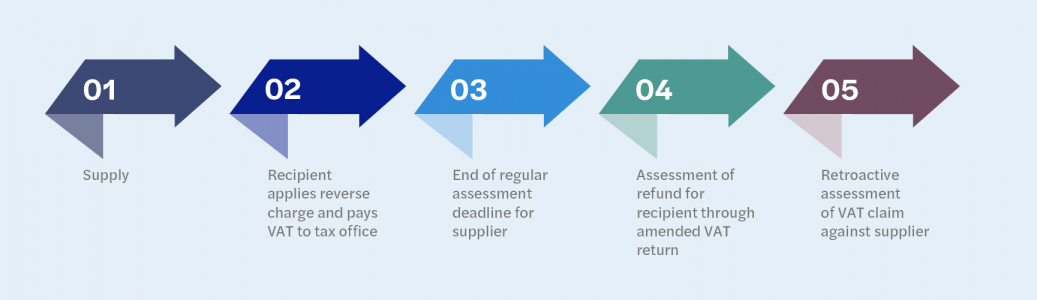

In both cases, the plaintiffs had provided construction supplies to property developers and, in accordance with the administrative opinion at the time, had applied the reverse charge procedure. In response to the 2013 BFH ruling, the recipients applied for a VAT refund. The tax offices responsible for the recipients assessed the refund in amended VAT assessments – but (and this is the decisive detail in the end) only after the expiry of the regular four-year tax assessment deadline applicable to the construction suppliers.

Does a suspension of the assessment deadline apply?

The tax authorities then demanded VAT from the construction suppliers after the expiry of the regular assessment deadline. In doing so, they invoked Section 171 (14) of the General Fiscal Code (AO), according to which the assessment deadline for a tax claim does not end if a related refund claim is not yet time-barred. The tax office was of the opinion that the refund claims of the recipients, i.e. the claims of the property developers for repayment of the wrongly paid reverse charge VAT, were not yet time-barred and that these were related to the tax claims of the tax office against the recipients within the meaning of the aforementioned provision.

Is an identity of person required for expiration inhibition?

The parties to the dispute had raised the question of whether such a connection was to be affirmed, although the tax subject to whom the refund claim is due (the recipient) and the party against whom the tax claim to be assessed is directed (the construction supplier) are two different persons. The BFH did not have to decide this because another aspect was decisive:

Assessment deadline once expired does not revive

Section 171 (14) General Fiscal Code only suspends the expiry of an assessment deadline that is still open but cannot restart an assessment deadline that has already expired. The suspension of expiration would therefore only apply if the refund claim of the recipient had arisen at a time when the assessment deadline concerning the construction supplier was still open.

For this purpose, it is important which point in time is to be regarded as the point in time at which the refund claim arises: under substantive law, the refund claim arises at the moment when a taxable person makes a payment to the tax office to which the tax office is not entitled. However, in the opinion of the court, this was not the point of reference for the application of Section 171 (14) of the General Fiscal Code. Rather, the decisive point in time was the time at which the tax office assessed the refund amount in an amended VAT assessment notice. According to this formal view, the refund claim of the developer had therefore only arisen when the regular four-year assessment deadline for the construction supplier had already expired and could therefore no longer suspend the expiry of the deadline for the construction supplier.

As a result, the tax office was no longer able to collect VAT from the supplier retrospectively.

Practice note: Carefully check retroactive claims for limitation of assessment

For construction suppliers against whom the tax office retroactively assesses VAT, it is worth taking a close look at the General Fiscal Code and coordinating with the recipient to check whether the retroactive assessment is still permissible. The tax office of the recipient must have assessed the refund claim of the recipient before the expiry of the regular four-year assessment deadline concerning the construction supplier, so that the tax office of the construction supplier can still claim VAT from the construction supplier after the expiry of this deadline with recourse to Section 171 (14) General Fiscal Code. Even if this requirement is met, it is still open whether Section 171 (14) General Fiscal Code is applicable at all in the absence of an identity of persons.

In addition, many other statutory suspensions of expiry are possible – § 171 General Fiscal Coe contains fifteen paragraphs in this respect. Due to the high degree of complexity, also with regard to the start of the four-year limitation period for assessment, which depends on the date of submission of the VAT return, we urgently recommend that you seek the advice of a tax advisor here.

(Dated: 13 January 2022)