Return of capital contributions by non-EU/EEA corporations – Initial statutory regulation by the German Annual Tax Act 2022

Current situation

The return of capital contributions by corporations is generally tax-neutral (non-taxable). The German Corporate Income Tax Act provides for the special regime of the tax contribution account for domestic cases, which is associated with a separate determination procedure.

This regime also applies in a similar form to distributions by EU/EEA corporations to their German shareholders. For distributions by non-EU/EEA corporations, on the other hand, there has been no statutory regime to date. Instead, the German Federal Fiscal Court has clarified in rulings from 2016 and 2019 that distributions by non-EU/EEA corporations for which no tax contribution account is maintained may also qualify as a return of capital contributions.

In a circular letter dated 21 April 2022, the tax authorities adopted the fiscal court rulings in their administrative practice and - in accordance with the fiscal court rulings - clarified that the application and deadline-bound determination procedure for the return of capital contributions does not apply to non-EU/EEA corporations. Instead, the burden of proof falls on the German shareholders of the non-EU/EEA corporation.

Transition period until 31 December 2022

In case of distributions by non-EU/EEA corporations, the previous administrative practice must be taken into account during the transition period until 31 December 2022 (the distribution date is decisive). For distributions made during this period, the burden of proof for the return of contributions lies with the German shareholders of the non-EU/EEA corporation as per circular letter dated 21 April 2022.

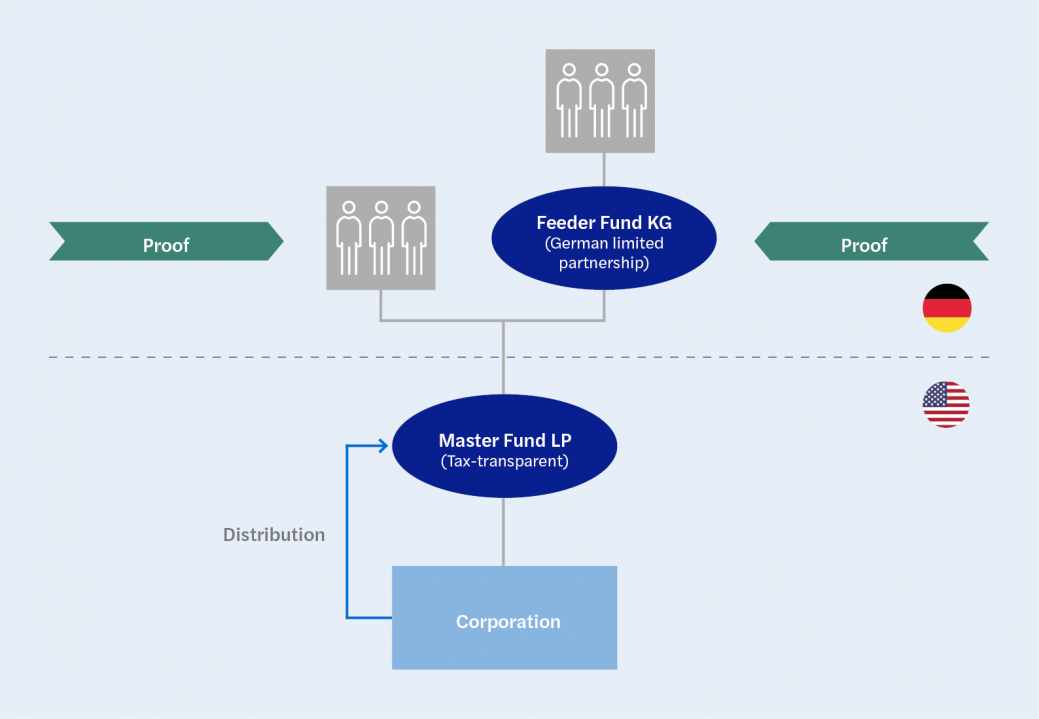

If the German shareholder of the non-EU/EEA corporation is a partnership (e.g., a fund partnership), the burden of proof must be fulfilled by the partnership itself but not by its partners (investors). If, however, the direct shareholder of the non-EU/EEA corporation is a foreign partnership with German partners, the German partners of the foreign partnership are obliged to provide evidence of the return of capital contributions (see the following chart).

Revision by German Annual Tax Act 2022

The Annual Tax Act 2022 passed by the German Bundestag on 2 December 2022 (approval by the Bundesrat has taken place on 16 December 2022) will now extend the statutory provision on the return of capital contributions (Sec. 27 Para. 8 German Corporate Income Tax Act) to include non-EU/EEA corporations. As a result, the return of capital contributions by non-EU/EEA corporations will also be subject to the formal determination procedure, which is subject to application and a deadline, from 2023 onwards. This means that the non-EU/EEA corporation that grants its German shareholders distributions that could potentially classify as return of capital contributions must file an application for the determination of this return of contributions. Therefore, the provision of proof for the return of capital contributions exclusively by the domestic shareholder is no longer sufficient. The application must be filed no later than the end of the 12th month following the end of the fiscal year of the non-EU/EEA corporation in which the distribution was made.

If the determination of the return of capital contributions is not applied for within this period , the payment of the foreign corporation is unavoidably taxable as a dividend at German shareholder level.

The revised regulation also solves a practical issue concerning hybrid foreign company forms, i.e. foreign companies that are considered corporations under German tax law but are treated as tax transparent in their country of domicile. The previous legal regulation requires an unlimited tax liability of the foreign company in its country of domicile for the application of the return of capital contributions, which, however, is regularly not given in the case of hybrid companies due to the transparent taxation there. The new regulation solves this issue by opening the scope of application for the return of capital contributions to corporations or associations of persons that are not subject to unlimited tax liability in Germany; the tax liability in the foreign country is therefore no longer relevant.

Application to private equity fund structures

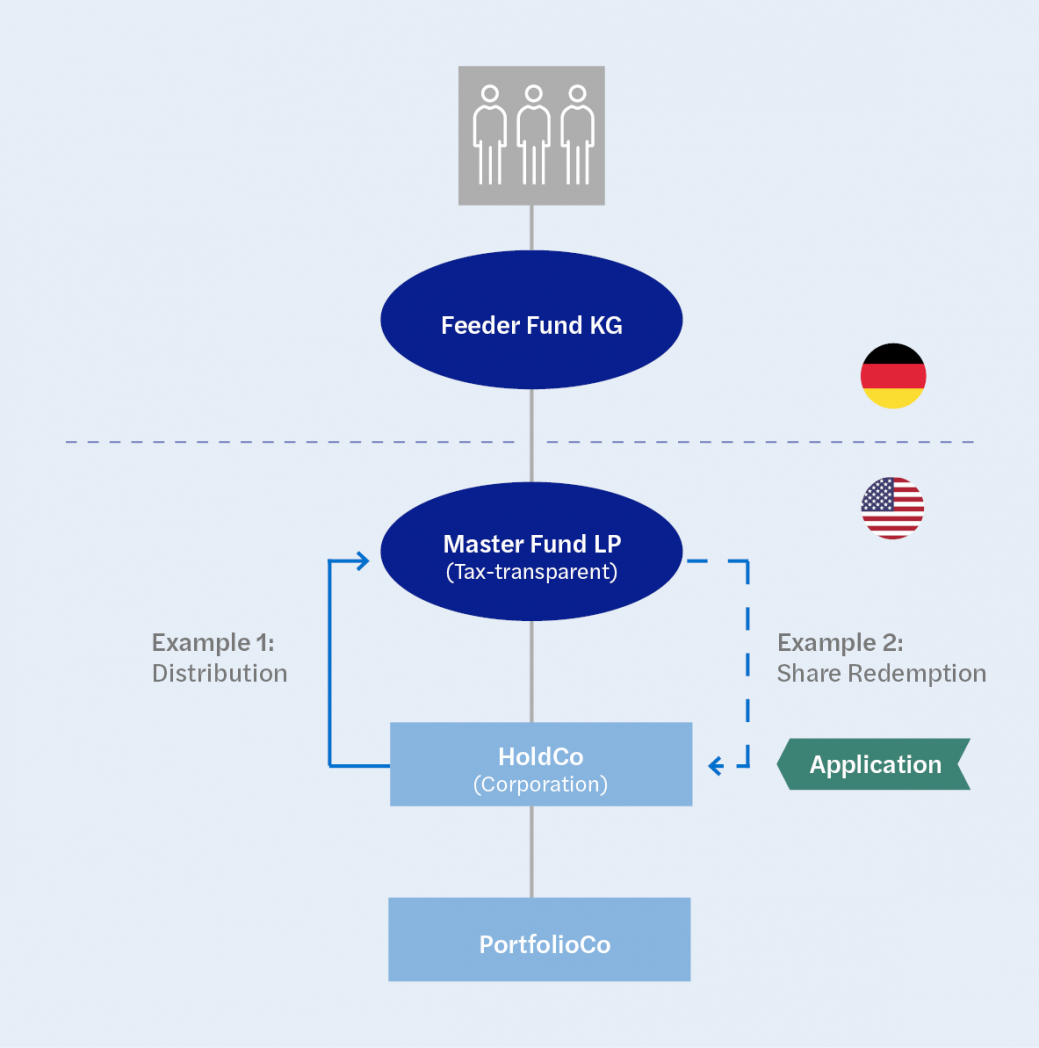

This change in the law will also have an impact on private equity funds and their investors. In principle, distributions from portfolio companies may qualify as a return of capital contribution, for which a corresponding determination procedure is required (see example 1 in the following figure). The issue of a return of capital contribution also arises, for example, when foreign corporations redeem their own shares (see example 2 in the following figure). With such share redemptions, the first question to be answered is whether – or to what extent – the transaction constitutes a distribution or a sale of shares from a German tax perspective. If the transaction qualifies as a distribution, it may potentially constitute a return of capital contribution, for which the application and deadline-bound determination procedure is required.

Summary

The inclusion of non-EU/EEA corporations in the scope of the statutory regulation on the return of capital contributions is generally to be welcomed, as it provides a uniform approach to the return of capital contributions by foreign corporations.

However, from a practical perspective, the regulation is rather complex, especially in cases where German shareholders hold an interest in the foreign corporation via (foreign) tax-transparent partnerships – possibly involving several tiers. Such participation structures are common in private equity fund structures, and German management teams and German investors will find themselves needing tax advice for this.