Taxonomy Regulation: New disclosure requirements for the classification of sustainable activities

Here you will find an overview of our services and solutions regarding the EU taxonomy.

Is your business affected?

Regulation (EU) 2020/852 ("Taxonomy Regulation") applies to all financial market participants providing financial products as well as to companies already required to publish a non-financial statement under the Non-Financial Reporting Directive (NFRD). These include publicly traded companies having either:

- 500 or more employees with assets totalling over 20 million euros

- Or 40 million euros in turnover

As soon as the Corporate Sustainability Reporting Directive (CSRD) replaces the NFRD as expected in 2024, the number of companies affected will be extended to include almost every company (except micro-enterprises):

- All companies listed on a European stock exchange (including non-European companies along with small and medium-sized enterprises (SMEs), but not micro-enterprises with fewer than 10 employees)

- All large, unlisted companies that meet two of the following three criteria: over 250 employees, 20 million euros in total assets, or 40 million euros in turnover.

What is the Taxonomy Regulation?

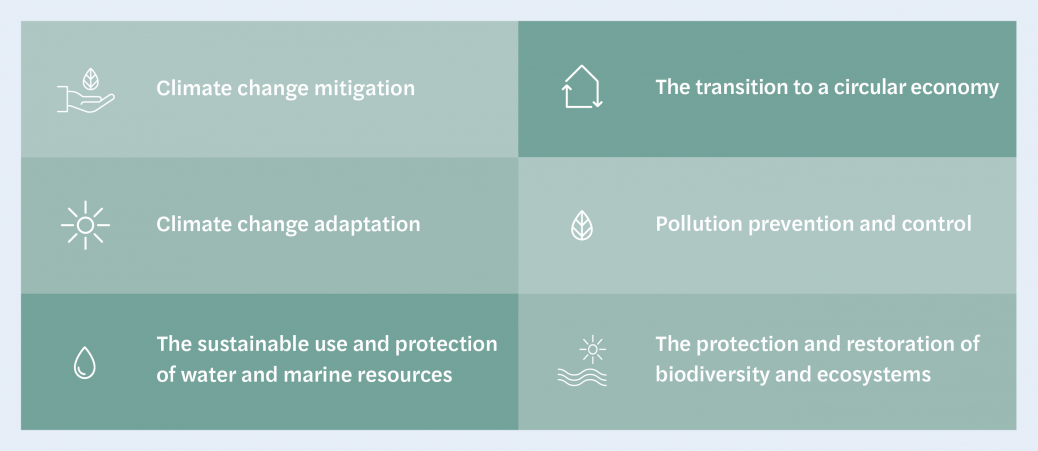

The EU taxonomy is used to determine whether an entrepreneurial activity is sustainable and contributes to the achievement of the six environmental goals outlined in the EU taxonomy. These include:

According to the Do No Significant Harm (DNSH) principle, it is not sufficient for an investment to serve at least one of the EU taxonomy’s six environmental objectives. It cannot conflict with any one of these objectives.

How does the European taxonomy work?

The EU taxonomy distinguishes between financial companies and non-financial companies. Non-financial companies go through a three-step process according to the taxonomy:

| Analysis of taxonomy applicability (“eligibility”) Activities explicitly listed in the taxonomy. The first two environmental targets cover economic activities in 13 macro sectors, which account for over 80 per cent of greenhouse gas emissions (source: ec.europa.eu). The taxonomy eligibility analysis determines which business activities meet the criteria defined by the taxonomy. |

| Analysis of conformity with the taxonomy ("alignment") Taxonomy-compliant activities will be considered to be aligned with taxonomy, and thus with the EU's environmental objectives, if they meet the following requirements:

Each activity must be checked to determine whether the specified analysis criteria have been met. |

Analysis of the contribution Once taxonomy-compliant activities have been identified, their share of the company's total activity must be calculated and made public – divided into revenue (turnover), investment (CapEx), and operating expenses (OpEx). This report shows where the company stands in relation to the EU’s taxonomy and sustainability objectives. |

The first provisions of the Taxonomy Regulation entered into force on 1 January 2022 and apply to all companies that are already required to publish a non-financial statement under the Non-Financial Reporting Directive (NFRD).

In accordance with the new guidelines, CSR reporting also extends the range of financial companies affected. Many smaller banks and savings banks, asset managers, investment companies, insurance companies, and reinsurance companies must prepare to report what percentage of their total assets or managed assets are taxonomy-compliant.

How Mazars can assist you

Mazars can assist you in all phases of implementing the EU taxonomy – from helping you understand the requirements, through project planning, analysis of relevant criteria, and the need to adapt the data, systems, and processes, to implementation and subsequent comprehensive reporting.