Reverse charge procedure for VAT groups as recipients of supplies - BMF circular letter dated 27 September 2022

Reverse charge VAT group BMF

BFH case: Reverse charge for construction supplies to members of a VAT group

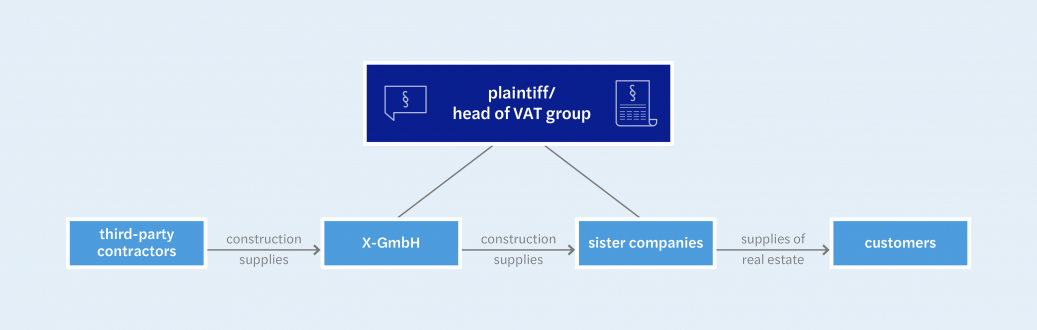

In the case underlying the BFH ruling, X-GmbH had provided construction supplies tosupplies for sister companies that, as property developers, did not render construction supplies but rather provided VATexempt supplies of immovable land. X-GmbH, in turn, procured the construction supplies provided to its sister companies from third-party contractors. X-GmbH and the sister companies were members of the same VAT group. The question to be clarified was whether the reverse charge procedure was applicable to the construction supplies provided by the third-party contractors to X-GmbH.

Pursuant to Section 13b of the German VAT Code in the version applicable in the disputed years and the associated case law, the reverse charge procedure was only applicable if the recipient of the construction supply used these services to provide construction supplies. Although the plaintiff and the third-party contractor initially assumed that the reverse charge procedure was applicable, the plaintiff later claimed during the appeal proceedings that this was incorrect. The tax office took the view that the decisive factor was the fact that X-GmbH had provided construction supplies to its sister company. Thus, the reverse charge procedure was applicable to the services of the third-party contractors. The fact that the services of X-GmbH were not taxable due to the VAT group was irrelevant. However, the BFH ruled that in the case of a VAT group, non-taxable internal sales were irrelevant and that what mattered was the question of in which of the VAT group’s external sales the construction supply was included. As the sister company did not provide any construction supplies externally, but rather just the real estate, the reverse charge procedure was not applicable to the construction supplies provided by the third party to X-GmbH.

BMF circular letter: BFH statements only partially affect new cases

In its letter, the BMF initially clarifies that the BFH ruling in an old case was issued before the law was changed on October 1, 2014. From this date onward, the application of the reverse charge procedure to construction work no longer depends on whether the recipient uses the construction supply procured to provide construction supplies. Since then, the only decisive factor has been that the recipient of the supply performs construction supplies on a sustained basis. According to Section 13b.3 (2) sentence 1 of the VAT Application Decree, this is the case if the entrepreneur generates at least 10 % of its global turnover from the performance of construction supplies. This can be assumed if the tax office has issued a corresponding certificate.

For new cases, one of the aspects of the BFH ruling on the old legal situation, according to which the construction supply procured must be included in another construction supply, is therefore no longer decisive. Following the BFH ruling, however, the BMF assumes that, in accordance with the current version of Section 13b of the German VAT Code (UStG), the question of whether this constitutes a sustainable provision of construction supplies depends on whether the VAT group as a whole derives at least 10% of its external sales from construction supplies. The BMF adjusts the VAT Application Decree in Section 13b.3 para. 7 sentence 3 accordingly and clarifies that non-taxable internal supplies are irrelevant in this respect.

Extension of the BFH principles to include gas, electricity, heating, cooling, and telecommunications

The BMF applies the principle - which states that internal supplies are not considered when a VAT group receives services - to two other situations beyond the case decided by the BFH:

For the supply of gas, electricity, heating, and cooling, whether or not the reverse charge procedure is applied pursuant to Section 13b (2) no. 5 in conjunction with Section 5 of the German VAT Code depends in some cases on whether the recipient of the supply is a reseller of these goods. Whether or not this person or entity is considered a reseller depends on what percentage of the procured are then resold. The BMF now clarifies in Section 13b.3a para. 3 sentence 2 of the VAT Application Decree that non-taxable intra-group sales within a VAT group are irrelevant when determining the reseller status.

The reverse charge procedure also applies to telecommunications services provided by entrepreneurs who are not resident abroad only if the recipient of the service is a reseller (Section 13b (2) no. 12 in conjunction with (5) sentence 6 of the German VAT Code). Here too, according to the current version of Section 13b.7b (5) sentence 2 of the VAT Application Decree, non-taxable intra-group transactions within a VAT group are to be disregarded when determining the reseller status.

Implications for practice

The BMF letter is to be applied in all open cases; there is no transitional period. Section 13b (5) sentence 8 of the German VAT Code generally speaking allows for the supplier and the recipient to agree to apply the reverse charge procedure in cases of doubt. However, any possible doubts must relate to how the supply should be classified by type, and not about any other facts of the matter. What this means for the cases involving VAT groups would have to be carefully examined on a case-by-case basis. In the future, entrepreneurs who provide supplies to members of a VAT group will have to closely examine how the VAT group’s external sales are to be judged.