Versatile, simple, efficient: the Pillar 2 tool from Mazars

Here you will find an overview of our services and solutions related to Pillar 2.

We help you analyse the impact of the Pillar 2 regulations on your business, and gather and aggregate all relevant data for your reporting. Our Pillar 2 tool serves as the foundation for fulfilling your Pillar 2 obligations. We use an integrated consulting and technology approach to guide you through the scoping, reporting, and centralised management necessary to achieve Pillar 2 governance.

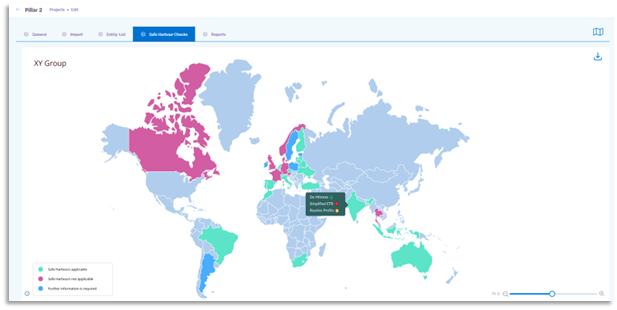

Our world map helps to quickly identify the countries where Safe Harbour rules apply. It also indicates where more information is needed.

We guide you on the path to Pillar 2 governance

The collaboration of our Pillar 2 experts and our Tax Technology team enables us to take a holistic approach to addressing the key challenges facing your company.

Our Pillar 2 tool offers you:

- An impact analysis to help you understand the effects of Pillar 2 regulations on your business

- A scoping with a guided enhancement and an assessment of the necessary GloBE data points

- A comprehensive tax calculation (comprehensive GloBE calculation)

- A real-time review of the Safe Harbour rules and identification of relevant business units

- An efficient analysis of, and enhanced data regarding, your "constituent entities" – structured, recurring, and comprehensively documented

- (Semi) automated reporting of your tax provisions

- A central location for gathering, processing, and reporting your Pillar 2 data.

- Seamless, integrated, interactive collaboration with our global teams

- Open data interfaces to the existing system landscape and further use of relevant data

As a "Software as a Service Solution" (SAAS), the tool is also an integral part of our Digital Tax Portal and thus features an extensive role and authorisation concept as well as numerous key functions.

Our customised approach

Play an active role in designing your customised solution to meet the challenges of global minimum taxation.

You have the choice of three options:

- Independent use: You use our Pillar 2 tool independently. Our teams are available to assist you with their tax and digital expertise as needed.

- Collaborative approach: You select which of our modular services you want, and we provide these. Regardless of whether this is scoping, comprehensive technical concept, data collection or implementation of the software solution.

- Fully managed service: You hire us as a complete service provider and provide us with your information and data. We take care of everything else.

An added plus: With our extensive data analytics expertise, we can also help you adapt and proactively shape your financial and consolidation processes. In addition, our experts help you implement cloud-based tax data management and analysis tools. This enables you to efficiently manage your data and ensures that you can continue to digitally fulfil your Pillar 2 reporting obligations.

Contact us to learn more about our Pillar 2 tool and services.