Partnerships as integrated companies - ECJ-ruling "M-GmbH" (C-868/19)

partnerships VAT group M-GmbH

V. Senate requires additional prerequisites, XI. Senate does not

The V. Senate of the BFH has so far held that a partnership can only be an integrated company of a VAT group if, apart from the head of the VAT group, only persons financially integrated into the head of the VAT group are shareholders of the integrated company. This view has also been included in Section 2.8 (5a) of the administrative guidelines to the German VAT Code and thus corresponds to the position of the tax authorities. The reason for this view is essentially that a partnership typically makes its decisions unanimously. If another person besides the head of the VAT group has an interest in the partnership, the head of the VAT group cannot assert itself in the partnership - unless the head of the VAT group controls this other person through financial integration. This indirectly allows the head of the VAT group to assert its will. Although the partnership can deviate from the unanimity principle by means of a partnership agreement, the V. Senate sees evidential difficulties here which impair legal certainty due to the fact that this agreement can be concluded verbally.

The XI. senate has not yet recognised this restriction.

ECJ: The partners in the partnership do not have to be financially integrated

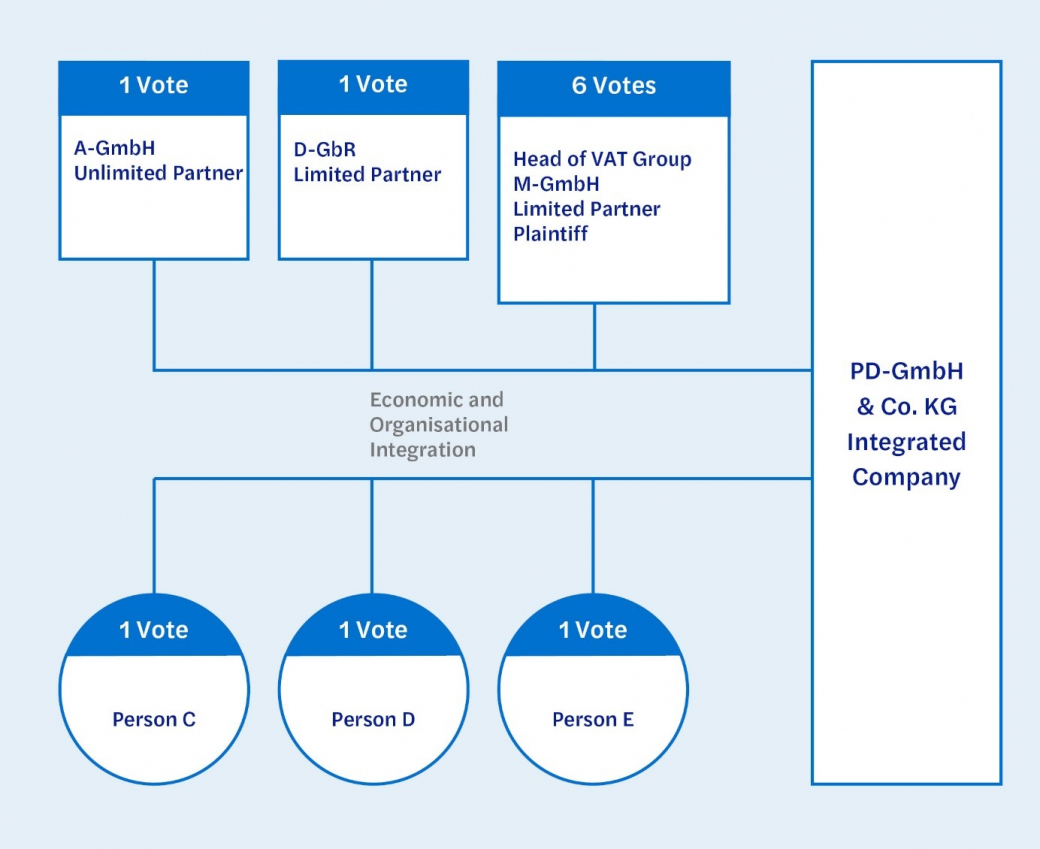

The ECJ has now clearly ruled that the extended requirements of the V. Senate and the tax administration are contrary to EU law. In the case underlying this judgement, a German GmbH & Co. KG was to be financially integrated as an integrated company into one of the limited partners, M-GmbH, although GmbH & Co. KG had further limited partners. According to the partnership agreement, with few exceptions, all resolutions in the GmbH & Co. KG were passed by a simple majority. M-GmbH had six votes, all other shareholders only one, so that M-GmbH was able to prevail in GmbH & Co. KG.

The ECJ decision decreed that the GmbH & Co. KG can be an integrated company of M-GmbH as the head of the VAT group in this constellation, although the other limited partners are not financially integrated into M-GmbH. The argument of the (purely theoretical) danger to legal certainty cannot be held against this. Nor does Article 11 (2) of the VAT Directive, which allows Member States to take measures to prevent tax evasion or avoidance in the case of VAT groups, permit such a restriction.

Recommendation: Review tax groups with partnerships

In the past, companies that expressly wanted to avoid the creation of a VAT group with a partnership as integrated company often worked to ensure the participation of another person not financially integrated into the potential head of the VAT group. According to the administrative guidelines of the German VAT Code, a VAT group is thus excluded. As long as the administrative guidelines are not amended, this possibility continues to exist in principle, but it is to be expected that the German Federal Ministry of Finance will adapt the administrative guidelines in this respect to the ECJ case law. Then, however, it should be possible (if desired) to prevent the VAT group by allocating votes in such a way that the head of the VAT group cannot enforce its will in the partnership. If a VAT group with a partnership is desired, however, despite persons not financially integrated into the head of the VAT group being involved in it, it is now possible to refer to the ECJ ruling discussed here, provided that the further conditions for integration are met. However, the prerequisite is that, depending on how the voting rights are allocated, the head of the VAT group can assert its will in the partnership despite the participation of further persons.

Since the legal consequences of a VAT group for VAT purposes exist as soon as the relevant requirements are met, companies should urgently check whether they have not "inadvertently" established a VAT group without intending to do so or having noticed it.

Dated: May 5, 2021