Penalty acquisition taxation in accordance with § 3d S. 2 of the German VAT Code - ECJ ruling "B." (C-696/20)

Acquisition taxation § 3d S. 2 UStG ECJ

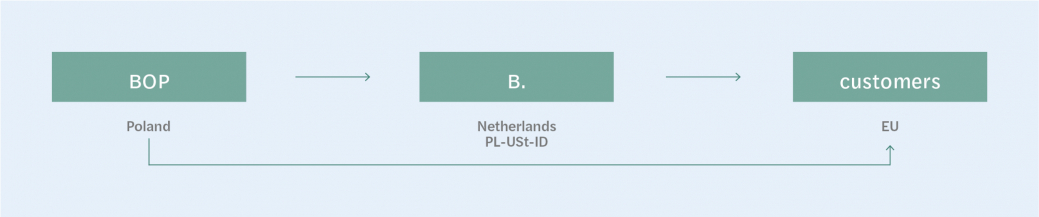

Facts of the case: Incorrect allocation of the moving supply of goods in a chain transaction

As part of a chain transaction, the Polish company BOP sold goods to the Dutch entrepreneur B., who then resold the goods to customers in various EU Member States. The parties assumed that the supply of goods by B. to its customers was the moving supply and thus to be treated as a VAT-exempt intra-Community supply in Poland because the movement of goods started there. Accordingly, B. used his Polish VAT ID. The customers declared these intra-Community acquisitions in their respective Member States. BOP issued invoices to B. with Polish VAT.

However, the Polish tax office concluded that the moving supply of goods had been incorrectly allocated. It viewed the supply of goods from BOP to B. as the intra-Community supply. Accordingly, B. should have declared intra-Community acquisitions in each of the Member States in which the movement of goods ended. However, because B. used the Polish VAT ID, he would have had to declare additional intra-Community acquisitions in Poland (Art. 41 VAT Directive; corresponds to § 3d S. 2 UStG – German VAT Code). Since BOP issued an invoice with Polish VAT, it would have had to apply the VAT rate of 23% (there is apparently no way to issue a correction in Poland). B. is not allowed to deduct this VAT as input VAT.

ECJ Decision

- Based on its findings of fact, the Polish tax authority concluded that the moving supply was the supply of goods from BOP to B. Because the Polish court did not question this, the ECJ did not have to review this.

- Art. 41 VAT Directive (which regulates the additional intra-Community acquisition when using an incorrect VAT ID) is also applicable if the VAT ID used is that of the Member State of departure. In the past, this has sometimes been questioned.

- It does not preclude application of Art. 41 VAT Directive if the intra-Community acquisition was taxed in the destination country by another taxable person - as in the present case in which the customers erroneously taxed these as intra-Community acquisitions. ECJ case law in the "Facet" case (judgement of 22 April 2010, C-536/08 and C-539/08) states that an intra-Community acquisition is, in principle, not to be taxed twice in accordance with Art. 41 VAT Directive. However, this only means that the actual acquisition, in this case the acquisition by B., may not be permanently taxed twice. The fact that persons other than B. have also wrongly declared acquisitions is irrelevant.

- However, the fact that under Polish law BOP must issue invoices with VAT, although its supplies are intra-Community supplies and B. is not entitled to any input VAT deduction in this respect, was regarded by the ECJ as a breach of the principles of neutrality and proportionality. This is because the Polish VAT has then been paid twice for a single supply of goods: First by BOP and then by B for the intra-Community acquisition in Poland because the Polish VAT ID was used. In such a case, Art. 41 VAT Directive therefore does not apply and B. does not have to declare intra-Community acquisitions in Poland.

Classification

The case decided here is, on the one hand, characterised by the special nature of Polish law, according to which the VAT statement in BOP's invoice cannot be reversed, unlike in Germany. On the other hand, it is an old case in which the quick fixes were not yet applicable.

Treatment of old cases in Germany

For old cases dating back to before the quick fixes were introduced on 1 January 2020, additional intra-Community acquisitions due to incorrect use of a German VAT ID should not be taxed if the person concerned received an incorrect invoice with German VAT from their supplier which cannot be deducted as input VAT due to Section 14c UStG (German VAT Code). However, the supplier in Germany can correct the invoice and refund the VAT to the customer, which eliminates the VAT owed. According to the ECJ's reasoning, the neutrality violation would then also be eliminated, so that the punitive acquisition tax under § 3d S. 2 UStG would then again be owed until the person concerned could prove that they had declared the acquisition in the destination country. It remains to be seen how the German tax authorities will deal with this in practice.

Quick fix repercussions

Intra-Community supplies of goods after the introduction of the quick fixes fall into two categories:

- If the recipient of an intra-Community supply of goods either does not use a VAT ID or uses the VAT ID of the departure country, the new regulation § 6a Abs. 1 Nr. 4 UStG does not consider this an intra-Community supply (see also 6a.1 Abs. 19 S. 6 UStAE - VAT Application Decree). The recipient can therefore claim an input VAT deduction since the introduction of the quick fixes. The ECJ ruling is not relevant here.

- However, if the recipient uses a VAT ID not corresponding to either the departure country or the destination country, this is considered a VAT-exempt intra-Community supply of goods and the acquisition is taxed in the country of the incorrectly used VAT ID in accordance with § 3d S. 2 UStG, provided that there is no intra-Community triangular transaction. What has been said for the old cases applies here.