Disclosure Regulation introduces new obligations for financial market participants

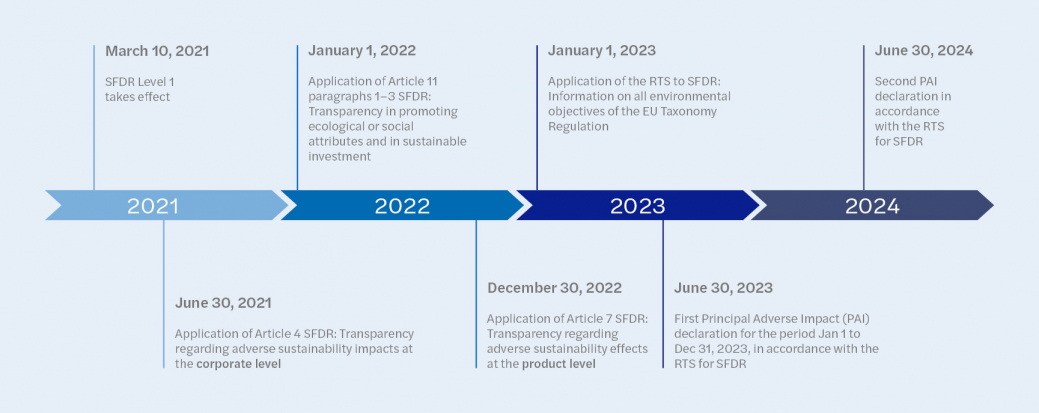

The new requirements include information on sustainability risks, potential adverse effects on sustainability and environmental or social aspects. In addition, beginning January 2023, the requirements of the Commission Delegated Regulation (EU) 2022/1288 (Regulatory Technical Standards, abbreviated as RTS) must be met and all six environmental objectives of the EU taxonomy must be taken into account when disclosing sustainability information.

Here you will find an overview of our services and solutions related to the Disclosure Regulation.

What does the new regulation mean for financial market participants?

The disclosure requirements are intended to enhance transparency in the financial market and to counteract information asymmetry by providing equal access to information. To this end, financial market participants and financial advisors must disclose on their website, in the pre-contractual information, and in regular reports, information that includes, among other things, the following:

- Consideration of sustainability risks in investment decisions (comply or explain)

- Adverse impact of investment decisions on sustainability factors (weighting and identification of key impacts and indicators)

- Compliance with responsible corporate management and international standards of due diligence

- To what extent the remuneration policy takes into account sustainability risks

- Methods for evaluating, measuring, and monitoring the economic and social characteristics of products, and which products support sustainable investment objectives

It should also be noted that elements of the EU Taxonomy Regulation are integrated into the disclosure requirements of the Disclosure Regulation.

When do the requirements of the Disclosure Regulation take effect?

Our timeline shows you the deadlines for compliance with each of the various Disclosure Regulation requirements.

How Mazars can assist you:

Our experts will help you meet all the impending challenges related to the Disclosure Regulation. We support you in implementing the regulatory requirements, including reporting, publication, quality assurance, and process optimization with our specialist expertise and practical experience. We take a holistic approach, analyze the status quo, determine what improvements are needed, and work together with you to implement them.