Legal adjustments to the extended trade tax exemption

On April 21, 2021, the German Parliament’s Finance Committee submitted its recommendations for the Fund Location Act (FoStoG). These recommendations include the long-awaited and absolutely necessary adaptation for the practical application of the extended trade tax deduction as defined in § 9 No. 1 p. 2 of the German Trade Tax Act (GewStG). The extended trade tax deduction is intended to ensure that corporations engaged solely in managing private assets are treated equally with regard to trade taxes. The de facto tax-free management of a property should be possible irrespective of a company’s legal form. Implementation of the law’s original justification has frequently faced obstacles in the past.

The requirements for application of § 9 No. 1 p. 2 of the German Trade Tax Act are interpreted very narrowly and have always been interpreted quite strictly in financial management and case law. In recent years, judicial treatment has become even stricter. Judicial decisions have focused on the law’s exact wording, which permits only the management and use of one's own property. Any other secondary activity, however minor (such as the joint leasing of a plant or the operation of a photovoltaic system), has immediately resulted in a denial of the extended trade tax deduction.

The new legislation was adopted by the German Parliament (Bundestag) on April 22, 2021. The extended deduction now expands the catalogue of non-prejudicial non-favoured activities to include three new activities. The following activities are now included in § 9 No. 1 Sentence 3 of the Trade Tax Act (GGewStG):

- Revenue from the supply of electricity in connection with the operation of renewable energy generation plants within the meaning of § 3 No 21 of the EEC

- Revenue from the supply of electricity generated by the operation of charging stations for electric vehicles or electric bicycles

- Income from direct contractual relations with the property’s lessees

For the supply of electricity as stated in 1 and 2, this revenue may not exceed ten percent of the revenue from the transfer of land use rights during the fiscal year in question. Revenue from the operation of power generation facilities shall not be derived from the supply to the final consumer unless this person or entity is the plant operator’s lessee.

This regulation provides legal certainty for all real estate-owning companies actively working to make the use of renewable energy and electric mobility more feasible. Until recently, it was highly uncertain whether a real estate-owning company was allowed to operate electric charging stations at all without jeopardising the extended trade tax deduction. This new regulation also supplements the obligation to install charging stations in accordance with the Electromobility Infrastructure Law passed on March 25, 2021.

For income derived from contractual relations with the lessees, this revenue may not exceed five percent of the revenue derived from the transfer of land use rights during the fiscal year in question. This regulation involves the long-requested de minimis limit for other secondary activities. Taxable persons or entities will benefit from this, in particular with regard to the small-scale leasing of technical facilities or other equipment, or the provision of other special services which exceed the asset management limit.

The new regulation on the extended trade tax deduction probably also found its way into the Fund Location Act due to interesting feedback related to the Investment Tax Law (InvStG). The preferential trade tax treatment of operating facilities amounting to five percent corresponds to regulation § 15 (3) of the Investment Tax Law (InvStG). Here, an investment fund is already exempt from the business tax if the total income derived from active commercial activities amounts to less than five percent.

It should be noted that any disposals of operating equipment and other equipment (e.g., in the case of outsourcing to an operator) do not fall within the non-prejudicial limit, as this does not affect the direct contractual relations with the lessees. With any restructuring plans, the way in which these are implemented must therefore continue to be considered.

Services related to the generation of electricity, the operation of charging stations, and other contractual relations with the lessees must be associated with the management and use of one’s own real estate.

The new requirements applicable to non-prejudicial activities constitute non-favoured activities. The revenue derived from this is not included in the amount of the deduction to be applied. Furthermore, only the business income directly attributable to the management and use of one’s own real estate is reduced. As a result, these services are non-prejudicial but subject to the trade tax. All secondary activities which cannot be directly assigned to the asset management must therefore continue to be examined in detail, appropriately qualified and monitored to ensure that they do not exceed the non-prejudicial threshold. The appropriate regulations must therefore be integrated into the Tax Compliance Management System.

It remains to be noted that the sometimes very complex task of identifying which assets among the entire inventory are deemed to be operating equipment is still necessary. In particular, the non-prejudicial activities (within the scope of the non-prejudicial limit) must now be declared as taxable commercial activities.

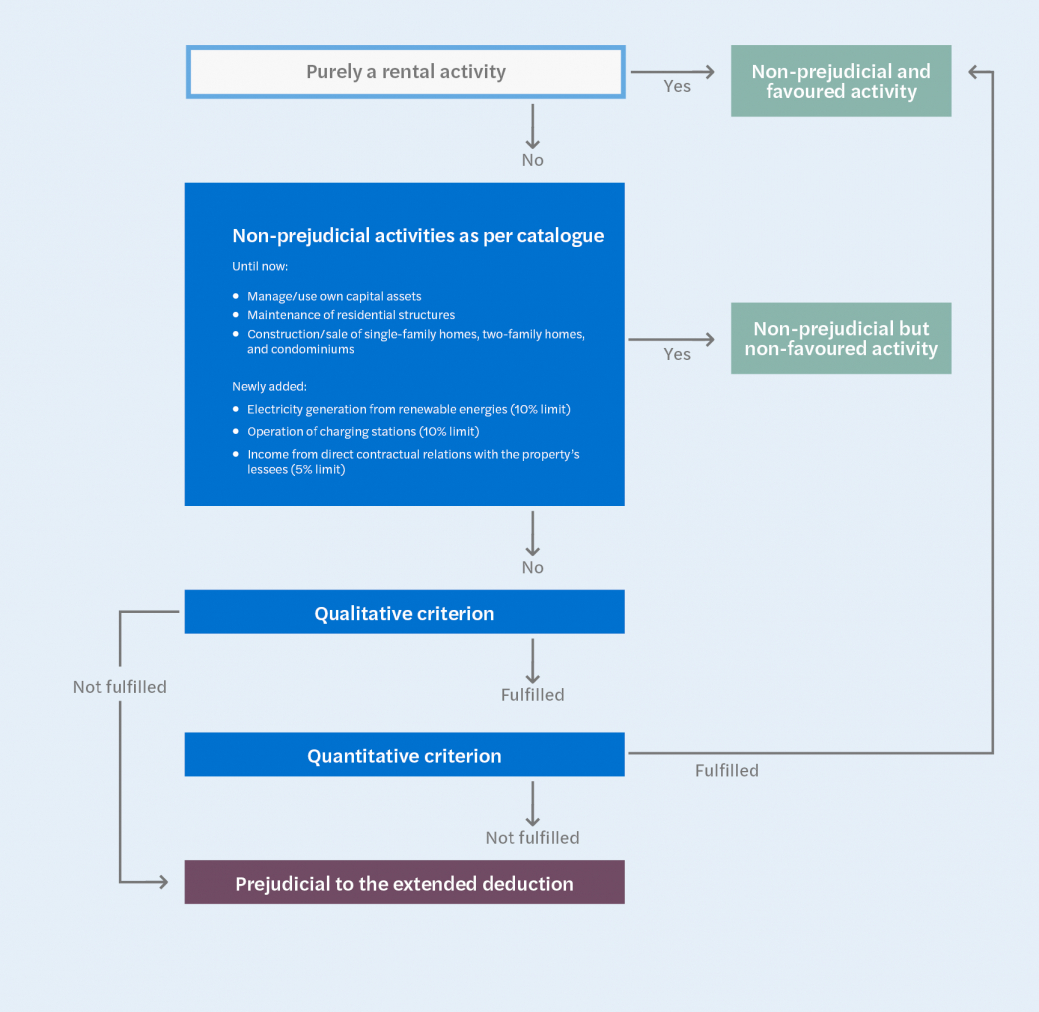

As soon as a secondary activity no longer fulfils the new requirements related to non-prejudicial activities, only the fulfilment of the so-called qualitative criterion can “rescue” the extended deduction. Only those activities deemed absolutely necessary for sound economic asset management are then considered non-prejudicial. “Absolutely necessary” in this context is considered to mean “indispensable”. If the qualitative criterion is met, the income derived from it must continue to be assessed in accordance with the quantitative criterion. However, a de minimis limit for secondary activities considered to be a mandatory element of asset management was not defined within the framework of the new regulation. It remains to be seen whether the case law will in the future apply the five percent limit here. To better explain this, we have created a simplified flowchart (shown at the end of this article) for assessing the extended deduction and have supplemented it with the new non-prejudicial status.

In our opinion, there is a certain degree of uncertainty in determining the ratio when calculating the percentage of secondary activity. The new regulation states “…not more than ten or five percent of the income from the use of the owned property". So, the question here is which property is to be placed. On the one hand, it could be interpreted to mean that the ratio calculation refers to the individual object within whose context the secondary activity is performed. Since jurisdiction and financial management have always taken a very strict approach when interpreting the extended deduction, it can be assumed that, for fiscal reasons, the individual object is considered when determining the ratio. This interpretation of the new regulation would, from a practical point of view, negate the non-prejudicial boundary. From the taxpayer’s point of view, therefore, one can only hope that it will be established that all one’s own real estate should be based on this. Further legislation could provide greater clarity and security.

Germany’s Federal Council is scheduled to meet on May 7, 2021. We cannot expect approval by the states to be a mere formality. As a municipal tax, business tax income constitutes a significant part of the state budgets. A possible reduction in the amount of taxable business income may therefore be critically scrutinised. It would be best if the Federal Council voted to adopt this regulation. Otherwise, we see little chance of it being implemented in this parliamentary term.