Impact and risks of the VAT Quick Fixes 2020

On 4 December 2019, as transitional solution prior to the implementation of the "definitive VAT system" ECOFIN passed the so-called quick fixes. They are basically about new rules for calloff stocks, stricter formal requirements for tax exemptions on intra-Community supplies and rules on allocating the “moved” supply of goods in a chain transaction. On 7 November 2019, the German parliament passed the 2019 Annual Tax Act without further changes to the government’s draft bill. At EU level, the EU Commission’s Directorate General Taxation and Customs Union (TAXUD) published the draft Explanatory Notes as an aid to interpretation. The VAT Committee (consisting of representatives of the Member States and the Commission) issued a Working Paper. These documents provide some clarification, but many open questions remain. The following Client Information reports on the current status of discussions, the need for action and the risks for businesses.

1. CALL-OFF STOCKS

WHAT IS THE ISSUE HERE?

EXAMPLE: An Italian supplier sells goods to a German customer and ships the goods to the customer’s warehouse in Germany. Title only passes to the customer when the goods are called off. Generally, the supplier must declare a deemed intra-Community supply of goods in Italy as well as an intra-Community acquisition and subsequent local supply of goods in Germany, i.e. the supplier has to register for VAT in Germany. In certain situations, case law has permitted the presumption of a direct intra-Community supply in Italy and an intra-Community acquisition by the customer, but to date there had been no respective legislation.

WHAT IS NEW AS OF 1 JANUARY 2020?

The new Art. 17a of the EU VAT Directive provides for a special rule for call-off stocks which Member States must implement by 1 January 2020.

In Germany, a new Section 6b Value Added Tax Act (UStG) was passed on 7 November 2019 which provides that under certain conditions a direct intra-Community supply can be assumed. The conditions are basically as follows:

- Name and address of the customer must be known to the supplier when the transport begins

- The customer has used the VAT ID issued by the destination country towards the supplier.

- The supply to the customer takes place within twelve months.

- The supplier is not established in the destination country.

- Specific recording obligations are met.

WHAT ARE THE CHALLENGES?

- Is there any choice when it comes to the application of the new legislation? Section 6b German VAT Act as amended does not provide for this; according to the TAXUD Explanatory Notes (draft) application of the simplification arrangements will be voluntary.

- When does a call-off stock become a fixed establishment which excludes the application of the rules on call-off stocks?

- What effect does the new legislation have on the case law of the German Federal Fiscal Court (BFH) on call-off stocks (BFH, judgement dated 20 October 2016, V R 31/15) if a binding order for the goods is issued prior to shipment?

- Businesses should review their supply chains as soon as possible. Existing VAT registrations due to call-off stock arrangements may have to be terminated. Conversely, new registration obligations may arise in cases where simplification rules were used in certain countries and these cannot meet the requirements under the new legislation.

- The revised German VAT Act (UStG) provides for additional recording obligations and requires a register to be kept – businesses must put the procedures in place for this as soon as possible.

- The revised version contains difficult provisions in the event that the goods are not delivered within twelve months, the customer is changed, the goods perish whilst in stock etc. This will require careful monitoring by the supplier – processes must be put in place for this as soon as possible.

- Even though the EU Commission’s VAT Committee has provided Explanatory Notes in order to clarify some aspects, many open questions remain.

- It is unlikely that all Member States will comply with implementation on time or that implementation will conform 100% to the Directive. When call-off stocks in another country are involved, clarification from local VAT experts is essential.

RISK

If German VAT is charged by mistake, the customer will not be able to deduct it. If the simplification arrangement is used even though the conditions do not apply, the VAT obligations in Germany or other EU Member States will not be met; this may result in tax arrears or may possibly have additional consequences. Our VAT team will be happy to help you with reviewing your call-off stock transactions.

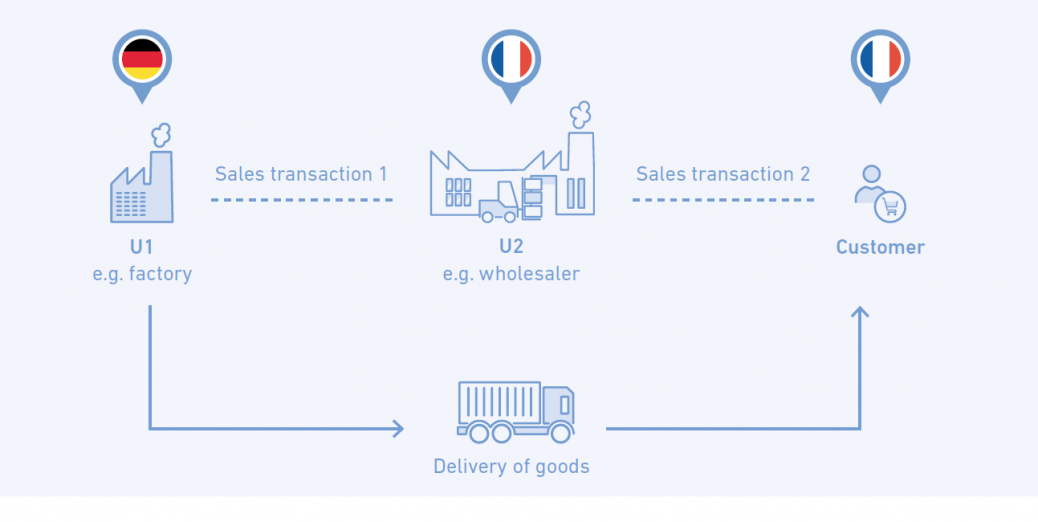

CHAIN TRANSACTIONS WITH SHIPPING BY AN INTERMEDIARY

WHAT IS THE ISSUE HERE?

EXAMPLE: The customer orders a machine from its wholesaler U2. U2 does not have the desired machine in stock and orders it from company U1. U2 collects the machine from U1 and brings it to its customer.

Clarification is required as to which of the supplies is the moved supply and thus may be exempt from VAT as an intra- Community supply. The existing version of Section 3 (6), sentence 6 German VAT Act (UStG) provides that this is generally the supply performed by U1 to U2, unless U2 proves that it is transporting the goods as the supplier. Currently, only the German VAT Application Decree (UStAE) specifies how this proof is to be provided. If U2 uses Incoterms which obligate it to bear the costs and risk of transport and if it uses the VAT ID of the Member State of dispatch towards U1, it may be presumed that U2 is shipping the goods as the supplier. Corresponding supporting documentation must be kept.

WHAT IS NEW AS OF 1 JANUARY 2020?

- Art. 36a of the EU VAT Directive obligates Member States to introduce a new system: Section 3 (6), sentences 5 and 6 German VAT Act will be cancelled. A new Section 3 (6a) will be introduced.

- This will bring in the following statutory rules: Where transport is carried out by an intermediary (until now usually referred to as the“middle company”) the supply to the latter is generally the tax-exempt supply unless the intermediary uses the VAT ID issued by the state of dispatch, prior to the start of transport.

- Where chain transactions involve a third country, this new rule under Section 3 (6a) will apply mutatis mutandis (not provided for in the EU VAT Directive). With regard to chain import transactions, the supply by the intermediary is the moved supply if the goods are imported on the intermediary’s behalf or, in the case of an indirect representation, for the intermediary’s account.

WHAT ARE THE CHALLENGES?

- When is a transport deemed to be direct?

- What happens if several shipping companies are involved, whether engaged by the same party or by multiple parties?

- What happens if the goods are stored temporarily?

- According to TAXUD, the intermediary will also be permitted to submit the VAT ID of the country of dispatch at a later date. This however contradicts the wording of Section 6 (6a) German VAT Act, as amended. How will the tax authorities handle this? Does it mean that VAT declarations can subsequently be modified at a later date?

- In Germany, the new rules will only have a minor impact on the status quo. The situation may be quite different in other Member States however - so it is essential to scrutinise chain transactions in other Member States.

Risk

If the implications of the new rules are misinterpreted and supplies wrongly treated as tax exempt, you risk incurring subsequent payments in the event of a tax audit, and a significant administrative burden.

The allocation of the moved supply also has an effect on the place of supply. Errors in this regard may mean that registration obligations in other countries are overlooked, the consequences of which may vary in severity depending on the Member State.

TAX EXEMPTION FOR INTRA-COMMUNITY SUPPLIES

WHAT IS THE ISSUE HERE?

EXAMPLE: A German supplier sells a machine to a French customer and has it shipped from Germany to France.

According to recent case law, this shipment, as an intracommunity supply, would be tax exempt if the supplier could “somehow” prove the cross-border movement of goods. This indicates that defects in formalities such as an incorrect Recapitulative Statement (RS) or a missing VAT ID of the customer may be harmless.

WHAT WILL CHANGE AS OF 1 JANUARY 2020?

- Art. 138 of the EU VAT Directive obligates Member States to introduce a new system: Section 4 No. 1b and Section 6a German VAT Act are being amended.

- This provides that prompt submission of a correct Recapitulative Statement (RS) and the use of the customer’s valid VAT ID issued by another Member State constitute essential requirements for exemption from tax.

- Art. 45a VAT Implementing Regulation contains new presumption rules on when proof of an intra-Community supply is deemed to have been provided. The VAT Implementing Regulation does not require a transposition into national law.

WHAT ARE THE CHALLENGES?

- We strongly advise you to review the customer’s VAT IDs prior to executing a supply of goods by way of a qualified check on the website of the Federal Central Tax Office for Taxes (Bundeszentralamt für Steuern – BZSt). The procedures for this should be put in place as soon as possible. Our VAT team will be happy to help you with this.

- When and in which form does the customer have to transmit the VAT ID to the supplier? The German VAT Act refers to “use”, the EU VAT Directive states “indicate”.

- Does the shipment have to be treated as taxable if the customer has not yet been issued a VAT ID at the time of shipment? Can or must this be subsequently corrected?

- Can the customer claim a deduction of input VAT if the supplier has treated the shipment as taxable due to the lack of a VAT ID? A future option allowing the customer’s VAT ID to be dispensed with and all cross-border shipments to be treated as taxable is likely to be ruled out.

- Can the shipment be treated as tax-free even if the RS has not yet been submitted because it was not yet due under the time limits?

- Are all errors in submission of the RS equally harmful or are there tolerances?

- What is the relationship between Article 45a VAT Implementing Regulation (MwSt-DVO) and the partially divergent evidence rules under the Sales Tax Implementing Regulation (UStDV)?

Risk

If the increased substantive requirements are not met, a tax audit may reassess a supplier’s tax-exempt turnover as taxable thus giving rise to retrospective VAT liability – with the corresponding risk of interest.

If a customer deducts input tax from an invoice for an intra-Community supply, this could be disputed by a company audit – risk: arrears, interest.