I. Special features

- The Maltese income tax system avoids economic double taxation through an imputation system (unlike a traditional corporate tax system such as the German one).

- Malta is not a tax haven but can offer very favourable taxation under certain conditions.

- Malta has neither an inheritance/gift tax nor a wealth tax (in general or as a property tax on immovable property).

- Malta can be easily integrated into a tax concept with other countries in the Mediterranean region.

II. Introduction

Malta is a small European country located between Sicily (Italy, approx. 100 km away) and Tunisia (approx. 300 km away). The archipelago consists of the main island of the same name, Malta, and Gozo and Comino as well as several uninhabited islands) has a population of around 520,000 people. Due to its geographical location, the Cathars, Romans, Byzantines, and Arabs all left their mark. Maltese, the national language, also shows influences of Arabic. English is also used as an official language.

The development of the country was characterised by two events: After the fall of the Crusader states and the loss of the island of Rhodes, which had been used in the meantime, the Order of Knights and Hospitallers of St John of Jerusalem moved its headquarters to Malta in 1530. This is why this order is also known as the Order of Malta. The presence of the Order over several centuries has left visible traces everywhere, even today. Visitors can recognise this in the fortresses, especially on the main island, and the Maltese Cross, which is not only used by both the (Catholic) Order of Malta and the (Protestant) Order of St. John but is also the national symbol of Malta.

Napoleon took over the archipelago in 1798 and the Order of Malta relocated to Rome, where it is still based today and continues to exist as an independent subject of international law (with its own government, state flag, and jurisdiction).

England took over the islands in 1800 and from 1814 - 1964 it was a crown colony in the British Commonwealth. It gained independence in the same year and has been a member of the European Union since 2004. Malta is therefore bound by European primary law, which in particular guarantees freedom of movement within the internal market and compliance with the ban on state aid, and Malta also fulfils its obligation to implement EU secondary legislation.

The long affiliation with Great Britain not only explains the widespread use of the English language and the left-hand traffic but also the influence on the Maltese tax system. One of the British specialties, namely the so-called non-dom status, can be found in many tax jurisdictions that have points of contact with Great Britain, including Malta (see below).

III. Overview of Maltese tax law

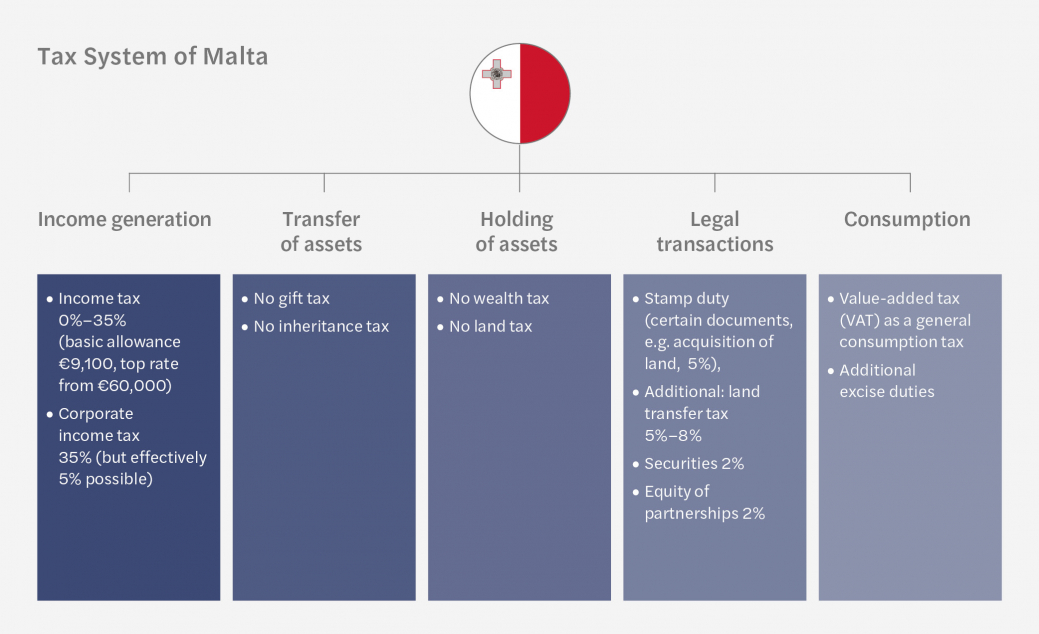

The Republic of Malta has a so-called multi-tax system, i.e. it utilises various tax sources to cover its financial requirements, but it is much simpler than in other countries, especially in comparison to the Federal Republic of Germany.

1. Income taxation

Income tax and corporation tax have their legal basis in the Income Tax Act of 1 January 1949 and the Income Tax Management Act of 23 September 1994, which essentially contains procedural components. Corporate tax is a form of income tax. Both taxes are linked by the imputation system applicable in Malta. Maltese income tax (as a generic term for income tax in the narrower sense and corporate tax) is generally based on a synthetic concept of income.

As is usual in countries with a connection to the United Kingdom of Great Britain and Northern Ireland, there is a special feature in the taxation regarding the scope of income. A distinction is made with descending intensity of tax access: taxation of global income, taxation on inflow to Malta, and taxation of domestic (i.e. Maltese) income only.

a) Income tax

The Maltese Income Tax Act distinguishes between resident and domiciled taxpayers under domestic law. This corresponds to the scope of unlimited income tax liability in Germany. Residency (ordinary residency) generally requires a stay of 183 days, but can also be established under other circumstances, in particular if the intention is to remain in Malta for a longer period of time, i.e. it depends on the actual relationship to the stay or activity in Malta. In addition, domicile is required. This is a personal criterion that expresses the individual's attachment to Malta. This is generally based on the domicile of the parents. You can only be domiciled in one country, and this can change. If there is a case of ordinary resident and domiciled status, the global income is taxed.

If, on the other hand, one of the two criteria is not met, i.e. either ordinary resident but not domiciled or vice versa, then taxation is based on the remittance-base taxation principle, i.e. only the income that is transferred to Malta or consumed there is taxed (typical case: credit card used in Malta). Individuals may be subject to a minimum tax of EUR 5,000 if their income arising outside of Malta exceeds EUR 35,000.

The individual may opt to be taxed on a worldwide basis, instead of the remittance basis, if their tax liability on a worldwide basis is less than the minimum tax.

If, on the other hand, there is neither residency nor domicile, taxation is the same as for a limited taxpayer, i.e. only Maltese income is subject to taxation.

Partnerships are transparent for tax purposes unless the corporate income tax option is exercised.

Taxation of income (generally net, in particular income from business operations and self-employment, but gross for income from employment, investment income, and letting and leasing) in the case of residence (with or without domicile) is based on a progressively increasing graduated rate. In addition to the basic rate described below, there is a further rate for married couples and parents.

Taxable income (in EUR) 2024 from to Rate Deduction amount | |||

Basic tariff | |||

0 | 9,100 | 0% | 0 |

9,101 | 14,500 | 15% | 1,365 |

14,501 | 19,500 | 25% | 2,815 |

19,501 | 60,000 | 25% | 2,725 |

60,001 | and over | 35% | 8,725 |

In the case of merely limited tax liability (non-resident individuals), taxation is based on the following rate (which is questionable under European law):

Taxable income (in EUR) 2024 from to Rate Deduction amount | |||

Basic tariff | |||

0 | 700 | 0% | 0 |

701 | 3.100 | 20% | 140 |

3.101 | 7.800 | 30% | 450 |

7.801 | 35% | 840 | |

Special features:

Interest from Maltese credit institutions or Maltese public law institutions is subject to a flat-rate withholding tax of 15%. Inclusion in regular taxation is possible upon request.

Dividends from a domestic corporation are subject to the imputation procedure, i.e. a dividend received is grossed up with the tax at source paid by the company and this amount is then taxable. The corporation tax paid is creditable resulting in a zero tax liability on such dividend income.

Rental income is deemed to be investment income unless the property is let on a commercial basis. Depending on the tenant, this results in gross taxation of between 5% (public authorities) and 15% (private individuals or companies) on a gross basis.

Gains from the sale of real estate (except for certain owner-occupied properties) are subject to an 8% tax on the market value at the time of transfer.

Losses can be carried forward, but not back. There are various restrictions.

Persons who are nationals of an EU/ EEA country and are subject to tax in Malta at the non-resident rates may opt to have their Malta-sourced income charged to tax using the resident rates if at least 90% of the individual’s worldwide income is derived from Malta.

In principle, no withholding tax is levied on dividends and interest, neither for unlimited nor limited taxpayers. Exceptions must be noted.

b) Corporate income tax

In corporate income tax law, a distinction is made according to whether a taxable entity is resident and domiciled or not. In the first case, taxation is based on global income. If there is residency but no domicile (or vice versa), only the income transferred to Malta is taxed, otherwise, only the domestic, i.e. Maltese, income is taxed.

Dividends and capital gains from favoured participations (including participations of 5% or more) are tax-exempt, provided they are EU companies, companies with a minimum tax rate of 15%, or companies of an active nature.

Corporations are subject to a tax rate of 35%. However, this tax rate can be reduced to 5% under certain conditions (e.g. if there is a Maltese two-tier company). A reduced rate would not apply if the profits were derived from immovable property located in Malta.

c) Preferential regime

Malta offers various preferential regimes and support programmes. In the past, there was the Seed Investment Scheme for start-ups, which the legislator replaced with the Malta Enterprise Investment Aid 2021 programme.

Malta also promotes the shipping industry with the Merchant Shipping Regulations, which allow tonnage taxation. The Malta Enterprise Act also offers further funding opportunities.

Malta continues to recognise preferential taxation for income from the use of intangible assets (so-called patent box). The regulation provides for a deduction of up to 95% of net income or profits from qualifying intangible assets after applying the degree of interdependence. As a result, the tax burden can be reduced to 1.75%.

d) Special incentives for immigration

(1) Incentives for non-EU/EEA citizens

The global residence programme favours immigrants from third countries who are not gainfully employed in Malta. Under certain conditions, foreign income is taxed linearly at 15%, but at least EUR 15,000 per year. To qualify for the programme, Maltese property must be worth at least EUR 275,000 or an annual rental payment of at least EUR 9,600.

(2) Incentives for EU/EEA citizens and Swiss nationals

The former programme for particularly wealthy individuals (High Net Worth Individual Rules) has been replaced by a residence programme (Residence Programme Rule) for citizens from the EU/EEA and Switzerland, provided they are not yet permanently resident in Malta. Foreign income of a taxpayer that is earned by beneficiaries or their relatives and transferred to Malta is also taxed at a reduced rate of 15%, here too at a minimum of EUR 15,000 per year.

For pensioners who receive a regular pension income, an additional Maltese programme (Maltese Retirement Programme) applies. The pension income must account for at least 75% of the pensioner's taxable income in Malta and must also be received there. Under certain conditions, taxation is 15% with a minimum tax of EUR 7,500.

There are also other preferential benefits.

2. Gift and inheritance tax, wealth tax, property tax

Malta does not levy inheritance/gift tax or wealth tax, either in general form or in relation to property, i.e. there is no property tax.

3. Transaction tax

Malta levies a so-called stamp duty on certain legal transactions. In practice, stamp duty is particularly important for property contracts. The basis of assessment is based on the market value and amounts to 5% for properties situated in Malta.

Malta also levies a property transfer tax of 8%, which is regulated in the Income Tax Act (see above). The rate can vary between 2% and 10% depending on the circumstances surrounding the property being transferred and the transferor.

4. Excise duties

In its implementation of the VAT Directive, Malta levies VAT at a standard rate of 18%. Certain services are subject to a reduced rate of 12% (hire of pleasure boats and services consisting of the care of the human body), 7% (accommodation and use of sports facilities), 5% (including food, medical equipment and supplies, printed matter, electricity, equipment for the disabled), 0% (including certain foodstuffs, medicines).

In addition, Malta levies special excise duties.

5. Double taxation agreements

Malta has a close DTA network, currently with 81 countries. A DTA with the Federal Republic of Germany dated 8 March 2001 with a revision protocol dated 17 June 2010 is in force. In line with Maltese negotiating practice, the DTA provides for the imputation method for income from the Federal Republic of Germany. The Federal Republic of Germany, on the other hand, has agreed on the exemption method for persons resident in Germany.